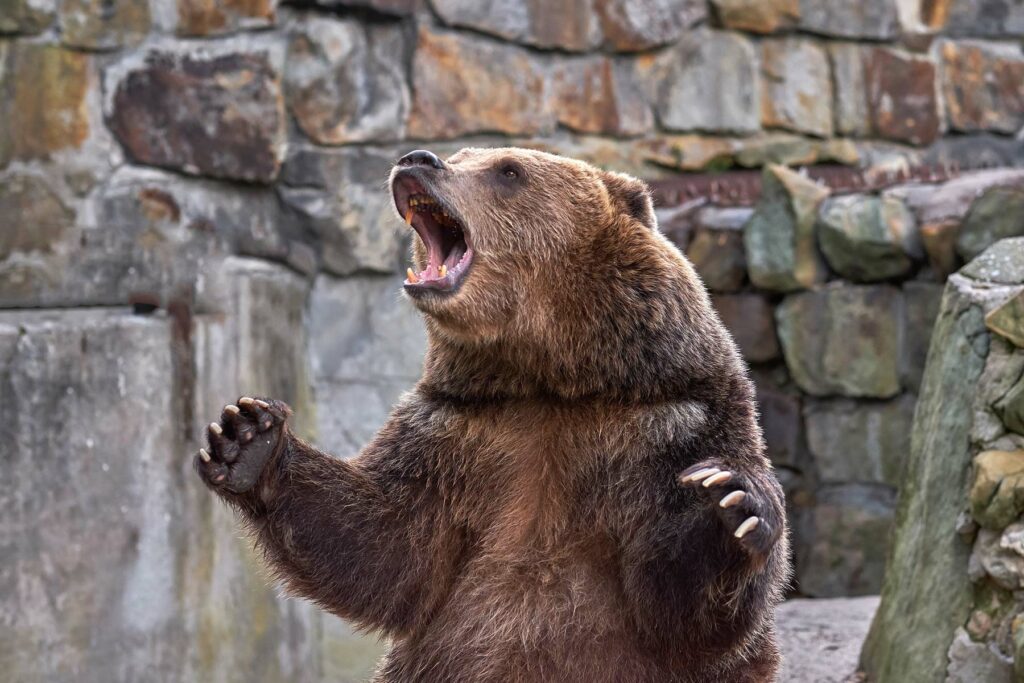

3 Stocks to Sell if You’re Bearish on Crypto

The largest cryptocurrency, Bitcoin, topped the $20,000 barrier on Friday on optimistic market sentiments about a possible drop in inflation numbers. The second largest crypto, Ether, also rose on Friday.

However, additional interest rate hikes will likely constrict the economy, which is expected to create pressure on the relatively riskier crypto market. Experts believe cryptocurrencies will continue a downtrend amid the volatile economic backdrop.

Moreover, digital currencies might face heightened regulations in the future. Gary Gensler, the current SEC chair, stated that the Commodity Futures Trading Commission (CFTC) needs greater authority to oversee and regulate crypto non-security tokens and related intermediaries.

Moreover, with the much-anticipated Ether merge expected to occur soon, the crypto market might experience more volatility. Hence, the blockchain stocks Block, Inc. (SQ), Coinbase Global, Inc. (COIN), and Riot Blockchain, Inc. (RIOT) might be best avoided now.

Block, Inc. (SQ)

SQ engages in the creation of tools that enable sellers to accept card payments and provides reporting and analytics and next-day settlement. The company also provides hardware products.

On July 13, SQ subsidiary Afterpay and beauty retailer Sephora announced their partnership to enable customers to pay for U.S. beauty brands and products in four installments. However, the gains from this partnership might be stretched over a long period of time.

For the fiscal second quarter that ended June 30, SQ’s total net revenue decreased 5.9% year-over-year to $4.40 billion. Adjusted net income decreased 56.8% from the prior-year quarter to $110.74 million. Adjusted net income per share declined 63.3% from the same period the prior year to $0.18.

The consensus revenue estimate of $17.60 billion for the fiscal year 2022 indicates a 0.3% year-over-year decrease.

The stock has declined 70% over the past year and 54% year-to-date to close its last trading stock at $74.29.

SQ’s POWR Ratings reflect this bleak outlook. The stock has an overall D rating, equating to a Sell in this proprietary rating system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

SQ has a Stability and Quality grade of D. In the 107-stock Financial Services (Enterprise) industry, SQ is ranked #91. The industry is rated F. Click here to learn more about POWR Ratings.

Coinbase Global, Inc. (COIN)

COIN offers financial infrastructure and technology for the global crypto economy. The company’s offerings include the primary financial account for retailers in the crypto space.

On September 8, Enthusiast Gaming Holdings Inc. (EGLX) announced its collaboration with COIN to introduce the company as its preferred infrastructure provider to power its Web3-enabled games portfolio. However, there might still be some time remaining before substantial gains can be realized from this venture.

COIN’s total revenue decreased 63.7% year-over-year to $808.33 million in the fiscal second quarter that ended June 30. Net income and net income per share attributable to common stockholders declined 168.1% and 177.6% from the prior-year period to a negative $1.09 billion and a negative $4.98.

Street EPS estimate for the fiscal quarter ending December 2022 of a negative $2.06 indicates a 162% year-over-year decrease. Likewise, Street revenue estimate for the same quarter of $752.68 million reflects a decline of 69.9% from the prior-year period.

Over the past year, the stock has declined 67.4% to close its last trading session at $80.87. It has declined 68% year-to-date.

It’s no surprise that COIN has an overall F rating, which translates to Strong Sell in the POWR Ratings system.

COIN has an F grade for Growth, Value, Stability, and Sentiment and a D for Quality. It is ranked #153 out of the 154 stocks in the Software – Application industry. The industry is rated F. Click here to learn more about POWR Ratings.

Riot Blockchain, Inc. (RIOT)

RIOT, with its subsidiaries, is engaged in cryptocurrency mining operations in North America. The company primarily focuses on Bitcoin mining with a large fleet of publicly-traded miners.

For the fiscal second quarter that ended June 30, RIOT’s total revenues increased 112.4% year-over-year to $72.95 million. However, its net income and net income per share came in at a negative $366.33 million and a negative $2.81, down 1,994.5% and 1,377.3% from the same period the prior year.

The consensus EPS estimate for the fiscal year 2022 of a negative $2.47 indicates a 2,987.5% year-over-year decrease.

The stock has declined 72.1% over the past year and 63% year-to-date to close its last trading session at $8.26.

RIOT’s bleak prospects are reflected in its POWR Ratings. The stock has an overall F rating, equating to a Strong Sell in this proprietary rating system.

RIOT has an F grade for Stability, Sentiment, and Quality and a D for Value. In the 81-stock Technology – Services industry, it is ranked #79. The industry is rated D. Click here to learn more about POWR Ratings.

About the Author

Anushka Dutta is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. With a master’s degree in economics, she aims to help investors identify untapped investment opportunities by looking at the fundamental factors. Anushka is a regular contributor for StockNews.com.

3 Stocks to Sell if You’re Bearish on Crypto Read More »