I enjoy reading and listening to the advice and opinions presented in financial news outlets. The discussions mainly focus on hot stocks for short-term gains. The ideas are interesting but rarely apply to investors who want to build long-term wealth. Last week, however, a Wall Street Journal article acknowledged the power of investing for dividends.

The headline?

The Best Ways to Jump into Dividend Stocks

With this sub-headline:

Lured by the prospect of steady income, investors are pouring billions into these inflation hedges without always understanding how they work

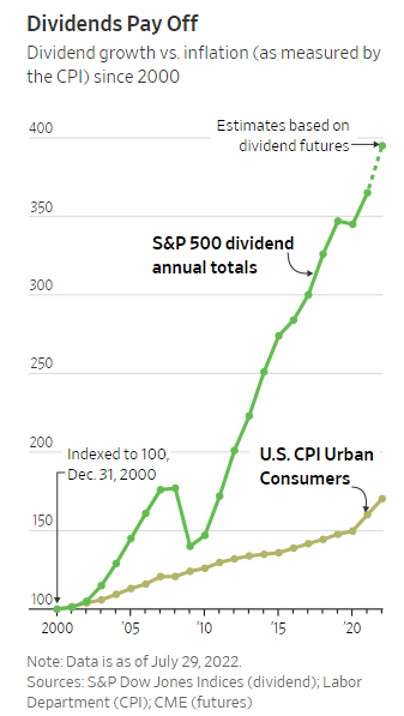

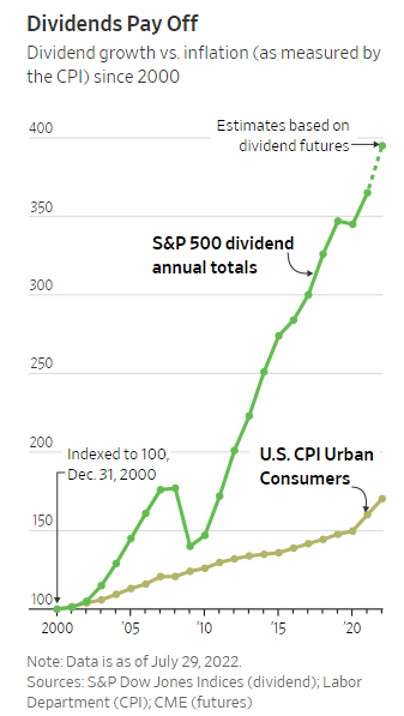

Then the article gets to the best part, which is this graphic…

In a nutshell, S&P 500 dividends have grown three times faster than inflation since 2000. About 400 of the 500 stocks pay dividends, and the index has a current average yield of 1.7%. The yield has stayed in a 1.3% to low-two percent range through the years.

Dividends have been the focus of my investment services since we launched the Dividend Hunter more than eight years ago. For this service, the recommended investments focus on high yield. Year in and year out, the yield averages around 8%.

Reinvesting the dividends will grow your portfolio income by 8%, compounding yearly. Many of the portfolio investments also organically grow their dividend rates. Investing for cash income lets you naturally load up on high-yield shares when the markets are down, which turns into higher income and wealth when stock prices recover. Take a look for yourself – now is a perfect time to get started, as you can lock in more income for less.

In my Monthly Dividend Multiplier service, the portfolio and strategy focus on stocks with growing dividends. The graphic above shows that dividend growth builds long-term income and wealth. The Monthly Dividend Multiplier portfolio yield of 4.6% is more than double the S&P 500. Interestingly, the portfolio returns consistently come in about double the S&P 500 returns. Click here to see how make that happen for your portfolio, too.

For investors like those discussed in the article, who are now getting into dividend-focused investing, my newsletters will give you a blueprint and the stocks to be successful.