The last few years have been difficult for the airline industry as it was among the biggest losers when the pandemic first hit in early 2020. However, with lesser restrictions on travel, the airline industry has bounced back strongly and is close to surpassing the pre-pandemic performance levels.

Delta Air Lines, Inc.’s (DAL) earnings and revenue exceeded analyst estimates in the fourth quarter.

Its EPS came 11.9% above the consensus estimate, while its revenue beat the estimate by 6.6%. The company’s operating margin came in at 10.9%, while its adjusted operating margin came in at 11.6%.

DAL’s CEO Ed Bastian said, “Delta people rose to the challenges of 2022, delivering industry-leading operational reliability and financial performance, and I’m looking forward to recognizing their achievements with over $500 million in profit-sharing payments next month.”

Glen Hauenstein, DAL’s President, said, “For the year, we delivered $45.60 billion in adjusted revenue, a $19 billion increase over the prior year, with record unit revenue performance expected to sustain a revenue premium to the industry of more than 110%. Momentum continues in 2023 with strong demand trends, and we expect March quarter adjusted revenue to be 14 to 17% higher than 2019 on capacity that is 1 percent lower.”

The company’s revenue passenger miles for the fourth quarter increased 24.9% year-over-year to 50.47 billion. Its passenger revenue per available seat mile increased 30.8% year-over-year to 18.30 cents.

Also, its total revenue per available seat mile (TRASM) increased 23.4% from the prior-year period to 22.58 cents. In addition, its total passenger revenue increased 50.4% year-over-year to $10.89 billion.

For the fiscal first quarter ending March 31, 2023, DAL expects its total revenue to increase 14% to 17% over the same quarter of 2019 and its operating margin to come in between 4% and 6%. Its EPS is expected to come between $0.15 and $0.40. For fiscal 2023, DAL expects its total revenue to increase 15% to 20% and operating margin to rise 10% to 12% over the previous year. Its EPS is expected to come between $5 to $6.

DAL’s CEO Ed Bastian said, “As we move into 2023, the industry backdrop for air travel remains favorable, and Delta is well positioned to deliver significant earnings and free cash flow growth.”

DAL’s President Glen Hauenstein said, “The recent rise in COVID cases associated with the omicron variant is expected to impact the pace of demand recovery early in the quarter, with recovery momentum resuming from President’s day weekend forward. Factoring this in to our outlook, we expect total March quarter revenue to recover to 72% to 76% of 2019 levels, compared to 74% in the December quarter.”

DAL is trading at a discount to its peers. The airline’s forward non-GAAP P/E of 7.40x is 57.1% lower than the 17.23x industry average. Its forward EV/EBITDA of 6.08x is 44.6% lower than the 10.97x industry average. Also, the stock’s 0.44x forward P/S is 66.6% lower than the 1.32x industry average.

DAL’s stock has gained 22.9% in price over the past three months and 27.2% over the past six months to close the last trading session at $38.26. Wall Street analysts expect the stock to hit $51 in the near term, indicating a potential upside of 33.3%.

Here’s what could influence DAL’s performance in the upcoming months:

Robust Financials

DAL’s total operating revenue for the year ended December 31, 2022, increased 69.2% year-over-year to $50.58 billion. Its operating income increased 94.1% year-over-year to $3.66 billion.

The company’s operating revenue increased 41.9% year-over-year to $13.44 billion for the fourth quarter ended December 31, 2022. Its non-GAAP net income increased 564.3% year-over-year to $950 million. In addition, its non-GAAP EPS came in at $1.48, representing an increase of 572.7% year-over-year.

Favorable Analyst Estimates

DAL’s EPS for fiscal 2023 and 2024 are expected to increase 61.6% and 29.8% year-over-year to $5.17 and $6.71, respectively. Its revenue for fiscal 2023 and 2024 is expected to increase 9.7% and 0.9% year-over-year to $55.49 billion and $56.01 billion, respectively.

Mixed Profitability

In terms of the trailing-12-month EBIT margin, DAL’s 7.57% is 22.2% lower than the 9.73% industry average. Its 2.61% trailing-12-month net income margin is 61.4% lower than the 6.75% industry average.

On the other hand, its 25.49% trailing-12-month Return on Common Equity is 79.6% higher than the industry average of 14.19%. In addition, its 10.64% trailing-12-month Capex/Sales is 259.6% higher than the industry average of 2.96% industry average.

Technical Indicators Show Promise

According to MarketClub’s Trade Triangles, the long-term trend for DAL has been UP since November 10, 2022, and its intermediate-term trend has been UP since January 6, 2023. However, the stock’s short-term trend has been DOWN since January 13, 2023.

The Trade Triangles are our proprietary indicators, comprised of weighted factors that include (but are not necessarily limited to) price change, percentage change, moving averages, and new highs/lows. The Trade Triangles point in the direction of short-term, intermediate, and long-term trends, looking for periods of alignment and, therefore, intense swings in price.

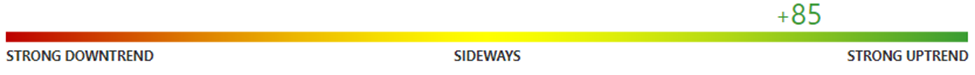

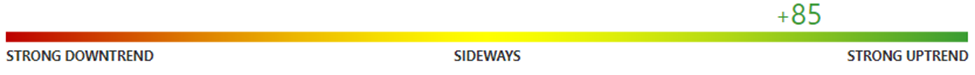

In terms of the Chart Analysis Score, another MarketClub proprietary tool, DAL, scored +85 on a scale from -100 (strong downtrend) to +100 (strong uptrend. While DAL shows short-term weakness, traders may look for the longer-term bullish trend to resume.

The Chart Analysis Score measures trend strength and direction based on five different timing thresholds. This tool takes into account intraday price action, new daily, weekly, and monthly highs and lows, and moving averages.

Click here to see the latest Score and Signals for DAL.

What’s Next for Delta Air Lines, Inc. (DAL)?

Remember, the markets move fast and things may quickly change for this stock. Our MarketClub members have access to entry and exit signals so they’ll know when the trend starts to reverse.

Join MarketClub now to see the latest signals and scores, get alerts, and read member-exclusive analysis for over 350K stocks, futures, ETFs, forex pairs and mutual funds.

Best,

The MarketClub Team

[email protected]