It does not matter which metric or statistic you use.

Stocks are not cheap based on any empirically proven valuation metric. The S&P 500 P/E ratio is over 25—not the highest level ever recorded, but certainly on the high end of the historical scale. And the average P/E ratio of the stocks in the tech-heavy NASDAQ 100 is 37, according to last Friday’s Wall Street Journal.

There are only two ways for the P/E ratio to decline toward more normalized levels. One isn’t happening, and the other isn’t pretty.

Here’s what to do now to prepare yourself and your portfolio…

The first is for earnings to rise sharply, and that is not in the cards. Revenues are slowing, wages and costs have been rising, and consumers are more cost-conscious than they were a year ago. We may not see an earning apocalypse anytime soon, but neither we will see explosive upside gains.

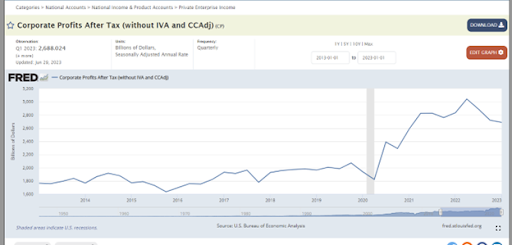

Keep in mind that we have already seen U.S. corporate profits decline almost 12% from the highs. If the Federal Reserve hikes rates another time or two and tips us into a recession, a 15–20% decline in corporate profits becomes highly likely.

Under any probable scenario, earnings will not rise enough to justify current valuation levels.

When I look at my favorite barometers of market valuation, every single one tells me that stock valuations are elevated, and the probability of high returns from these levels is declining. The Fed may or may not raise rates at the September meeting. The CPI report reduced the likelihood of a hike, and the PPI put it back on the table.

Energy is the big question mark. Crude oil has rallied more than 20% since the lows in late June. Even natural gas, the Oakland A’s of the energy complex, has been trying to rally the past couple of months.

Rents may stop going up, but I do not expect them to decline significantly, either.

The Fed’s decision is more challenging than the headlines may indicate. Even if that august body of economists and career bureaucrats does not raise rates, they will not lower them anytime soon, either.

Interest rates are part of every valuation model. Higher rates mean businesses are worth less, and rates have gone from almost zero to 5.5% in less than 18 months. Yet rates do not appear to be priced into the market, in my not-always-so-humble opinion.

Does all this mean that the stock market is going to collapse soon?

I have no idea. Sentiment and momentum are both positive right now.

Momentum lasts until it stops. The problem is that when it does stop, it can be a somewhat violent shift.

So, should I sell all my stocks?

Maybe. Do you love the company? Is it a potential 100-bagger? Keep those.

Is its turnaround nearing full value or does the company rely on continued economic strength to profit? It is time to say goodbye to those.

You should, however, be careful about buying stocks in the most overheated part of the stock market.

Artificial intelligence is coming, and it is wonderful, but to justify the current price of NVIDIA Corp. (NVDA), the company must grow by more than 20% a year for decades.

Most money-losing AI stocks touted as the next big thing will not be, so it is not a time to be buying with reckless abandon. Be selective.

Instead, look for opportunities to buy good companies in sectors and industries the markets hate. The best banks, REITs, natural gas companies, and broadcast television companies will be much higher in a few years. And many of these unpopular companies will be taken over at a premium to the current stock price.

Buy on big down days. Stay small, move slowly, and accumulate positions over time.

You cannot be an extraordinary investor if you are doing what everyone else does.