With the stock market tumbling, investors are on the hunt for safer investments that pay attractive returns. The fact that you can earn 9.62% from a U.S. Savings Bond is getting a lot of buzz.

Today, let’s review the features, pros, and cons of investing in these Series I Savings Bonds.

The U.S. government sells two types of saving bonds. We may remember the Series EE Bonds from our youth when we received them as gifts. EE Bonds pay a fixed rate, currently set at 0.10%.

Series I Bonds pay a fixed rate plus the inflation rate. The fixed-rate sits at 0.0%; however, the inflation rate portion is currently set at 9.62%.

Series I Bond rates are set twice a year on May 1 and November 1. The rate you initially earn will be in effect for the six-month window when you purchase your I Bonds. To lock in the current 9.62% rate, you must buy I Bonds no later than October 28.

Series I Bonds compound semi-annually. This means if you buy an I Bond now, it will earn 9.62% for six months, and then the rate will reset to the rate in effect on the semi-annual anniversary date. Simply put, the Series I Savings Bond rate resets every six months.

Here are the features of Series I Savings:

- You can buy up to $10,000 of electronic I Bonds per year per person. You buy bonds through the Treasury Direct website.

- You can buy electronic bonds for any amount of $25.00 or greater.

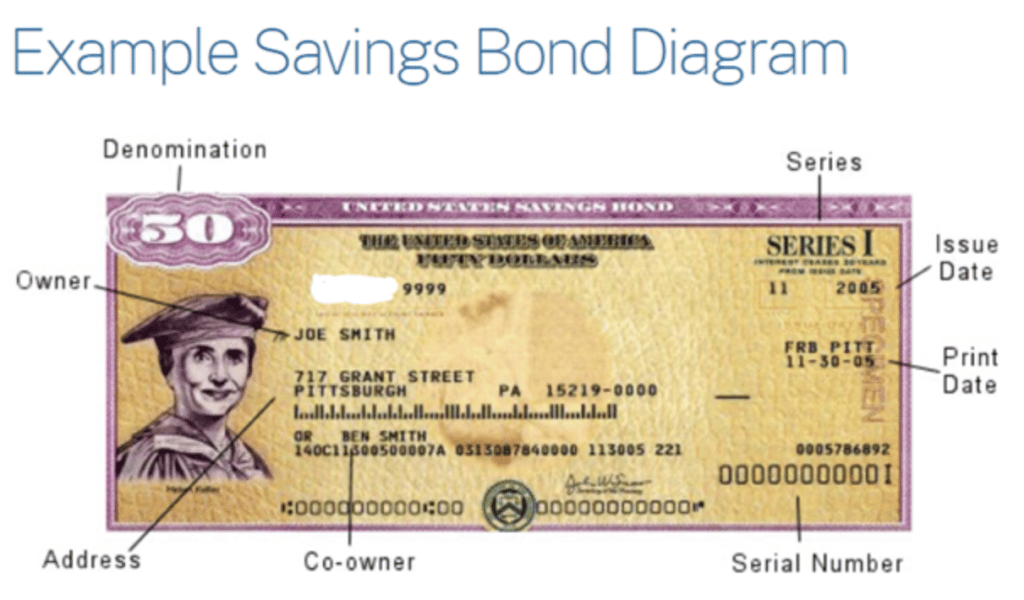

- You can invest up to $5,000 of your federal tax return into paper I Bonds.

- Paper bonds come in denominations of $50, $100, $200, $500, and $1,000.

- I Bonds earn interest for up to 30 years.

- You can redeem a bond after one year, but if you redeem during the first five years, you will be charged a three-month interest penalty.

- I Bond interest is exempt from state income tax.

- For federal income taxes, you can declare the interest each year and pay taxes or let the interest grow tax-deferred until you redeem the bonds.

Overall, in this era of high inflation, Series I Bonds are a pretty good place to sock away some money.

But, there are some potential pitfalls to consider:

- The $10,000 annual investment cap limits how much money you can put into I Bonds. You can’t sock away your entire nest egg and earn a government guaranteed 9.62%.

- Interest compounds to the value of the bond. You cannot elect to have the interest paid out. Your earnings will be tied up until you redeem the bonds.

- The semi-annual rate reset means you may earn a much lower interest rate in the future. The next reset on November 1 should be very attractive, but the rate could be much lower a few years later.

If you can live with the restrictions, Series I Savings Bonds offer an attractive, U.S. government-guaranteed return with the current 9.62% yield (if purchased before October 28), and can provide some stability to your investment portfolio. You can buy savings bonds through an account on the TreasuryDirect.gov website.

This is the easiest way to reach your income goals faster. For example, instead of collecting $1,000 per year in dividends, you could potentially increase your yearly income to $4,000 or more. And LIVE on October 20th, I’m revealing exactly how this simple strategy works. Get your ticket here.