After nearly two years of a bear market, unprecedented interest rate hikes, and general macro- uncertainty, which unnerved investors and led to volatile trading, things have finally calmed down over the past few weeks.

Over the past month, the Chicago Options Exchange Volatility Index (VIX), dropped from 22 to 13; one of the steepest slides in two years and its lowest level since prior to February of 2020. This suggests investors expect relatively smooth sailing for the foreseeable future.

However, it might be premature to become complacent or overly optimistic. This week there are several events which might unnerve investors and induce a renewed round of market volatility.

Items on the calendar this week include key economics data such a the Consumer Price Index (CPI) and Producer Price Index (PPI), retail sales data, and the all-important Federal Open Market Committee Meeting (FOMC), in which Chairman Powell will reveal the Fed’s planned path for interest rate policy.

With the VIX at a multi-year low, it might make sense to look at some volatility-based ETFs that would benefit from either a sell-off or simply an increase in price swings and market volatility.

Before getting to a few of the ETFs we can employ, there are a few things we need to understand about VIX-based products.

The VIX itself cannot be traded. It is simply an index which is calculated based on the implied volatility of a mix of the S&P 500 Index options. These products are linked to volatility futures. They own or short futures based on the CBOE Volatility Index (VIX). The VIX index portrays the price volatility embedded in the option prices of the S&P 500 Index for the next 30 days.

Investors need to understand that these funds track the futures on the VIX and not VIX itself. Because of the nature of the VIX futures markets, the rolling cost of futures may be detrimental to performance results. Thus, these products may lose money over the long term. Investors need to approach these products with care.

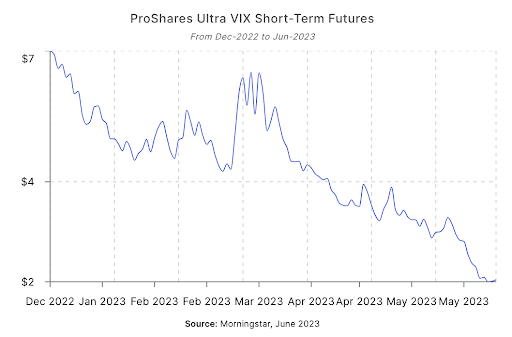

The ProShares Ultra-Short Term Volatility ETF (UVXY) is one of the more popular ways to play the VIX index as investors can bet on increases in the expected volatility of the S&P 500, as measured by the prices of VIX futures contracts.

UVXY started trading all the way back on October 3, 2011 with an expense ratio of 0.95% and total assets under management of $481 million. Volume averages around 45 million a day.

It uses a 1.5x leveraged exposure to the index investing in the first- and second-month VIX futures with a weighted average maturity of 30 days.

The fund rebalances every day, so it’s not a product to be held very long. A good time horizon would be no more than 2 weeks as the daily reset can result in negative compounding effects.

Highlighting the long-term downward pressure on Monday the UVXY will undergo its 11th reverse split since its inception; on adjusted it is now down 99.9% from its split adjusted first day closing price of $2,058,000,000.

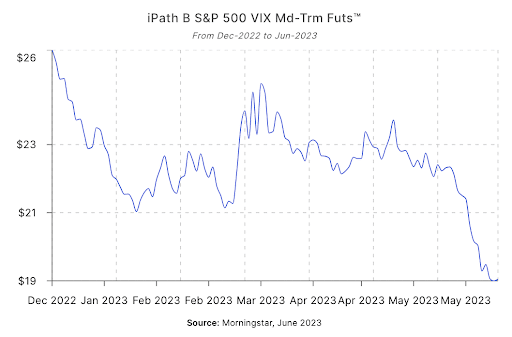

The iPath S&P VIX Mid-Term (VXZ) is an exchange-traded note (ETN) that tracks the performance of medium-term VIX futures contracts. This gives a way to bet on the S&P 500 using its exposure to VIX futures with average 5-month maturity.

The use of future contracts typically between 4 and 7 months allows investors to capture exposure to volatility over a longer time horizon.

The longer time frame can be advantages when compared to other volatility products by reducing the potential negative impact of contango.

Using the further out contracts can help lower the costs vs. volatility products that continuously roll over their positions.

Assets under management are a mere $56 million with an expense ratio of 0.89%. VXZ is a leveraged product, which means that its returns are magnified relative to the underlying index. This can lead to significant losses if the market declines. The price is hovering at $19 a share, which is a 3-year low.

It is down only 10% for the year to date, which compares favorably to UVXY’s 50% drop during the same period.

Sign up for the All Star Funds VIP content complete with actionable insights to put your Magnifi portfolio in the best possible position to capture all the value ahead!