Over the past few months, as Powell & Co. made it clear they would stay the course of rates going higher for longer, many people abandoned any nuanced analysis of ‘dot-plots’, terminal rates or curve inversion and adopted the stance the Fed would simply keep tightening “until something breaks.”

I would venture to say last week’s failure of Silicon Valley Bank (SIVB), which at $200 billion was the second largest in history, and the following intervention by the FDIC and bailout/backstop for depositors to prevent a contagious run on other regional banks qualifies as something breaking.

So how do we put it all back together? Or more importantly, how do we take advantage of this state of confusion.

Remember, from chaos comes opportunity.

For option traders, chaos expresses itself as increased volatility, both realized and implied, and the pump in premiums has drawn to selling iron condors to take advantage of the dislocation.

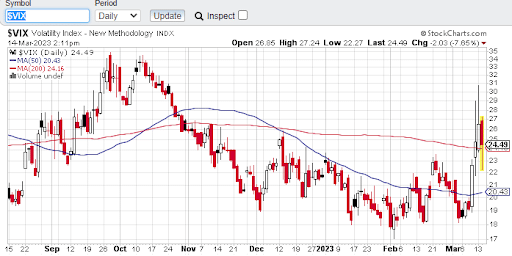

The CBOE S&P 500 Volatility Index (VIX), which is a broad measure of market volatility, shows recent events certainly spooked investors. The VIX spiked to its highest level in 6 months.

My view is the recent price action, in which full asset classes such as Treasury Notes, some sectors, like regional banks and certainly individual names, experienced 10 sigma moves – that would be 10 standard deviations from the 12-month expectations – will now have a reversion to mean.

This expectation for a stabilization in price has me drawn to iron condors like a moth hooked on meth fueled lightbulb.

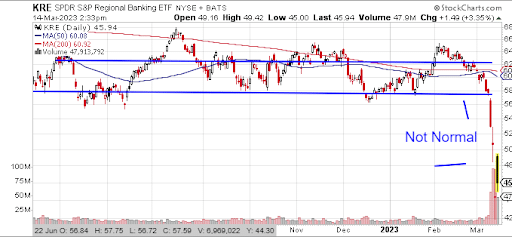

The first move Options360 made on Monday was to establish an iron condor in the SPDR S&P Regional Bank ETF (KRE); this sector ETF, which includes SIVB, First Regional Bank (FRC) and Western Alliance (WAL), has dropped over 18% in the last week; that’s not normal for the banking business.

Check out Magnifi.com to find other ETFs with bank exposure

So, yes, I dove straight into the center of the storm by establishing an iron condor, which consists of simultaneously selling both a put spread and call spread as a means of collecting premium.

While I can’t give the details of the specific trade, my expectation is that KRE will hold between $45 and $53 over the next week or two. More importantly, implied volatility for the sector will decline from over 115%, the highest level since the 2008 financial crisis, back towards the 52- average of 19% as the dust settles and reversion takes hold.

Don’t miss any trades. Join the Options360 trading community today!